The ultimate bridging solution for tokens and chains

21 Chains Connected

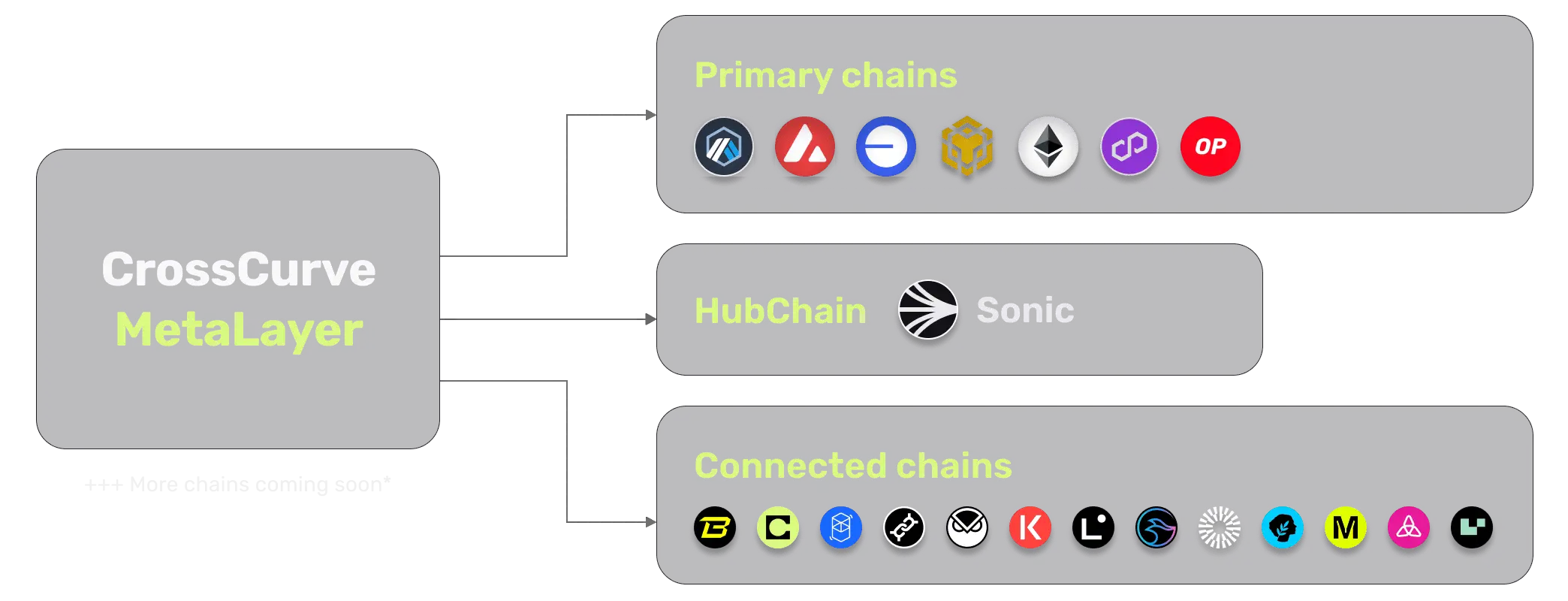

Cross-chain interconnection powered by the CrossCurve MetaLayer

The CrossCurve MetaLayer connects 21 blockchains, ensuring seamless cross-chain liquidity and interoperability. With primary chains like Avalanche, Arbitrum, Binance Smart Chain, Ethereum, and Optimism, alongside HubChain and Sonic for enhanced integration, CrossCurve provides fast, secure, and low-slippage transactions across a wide range of ecosystems. The addition of connected chains like Cosmos, Kava, and Polygon further expands the liquidity pool, with more chains to be integrated in the future, solidifying CrossCurve as a leading solution in cross-chain connectivity.

CrossCurve: The Future of Cross-Chain Liquidity Management

Empowered by Decentralized Governance

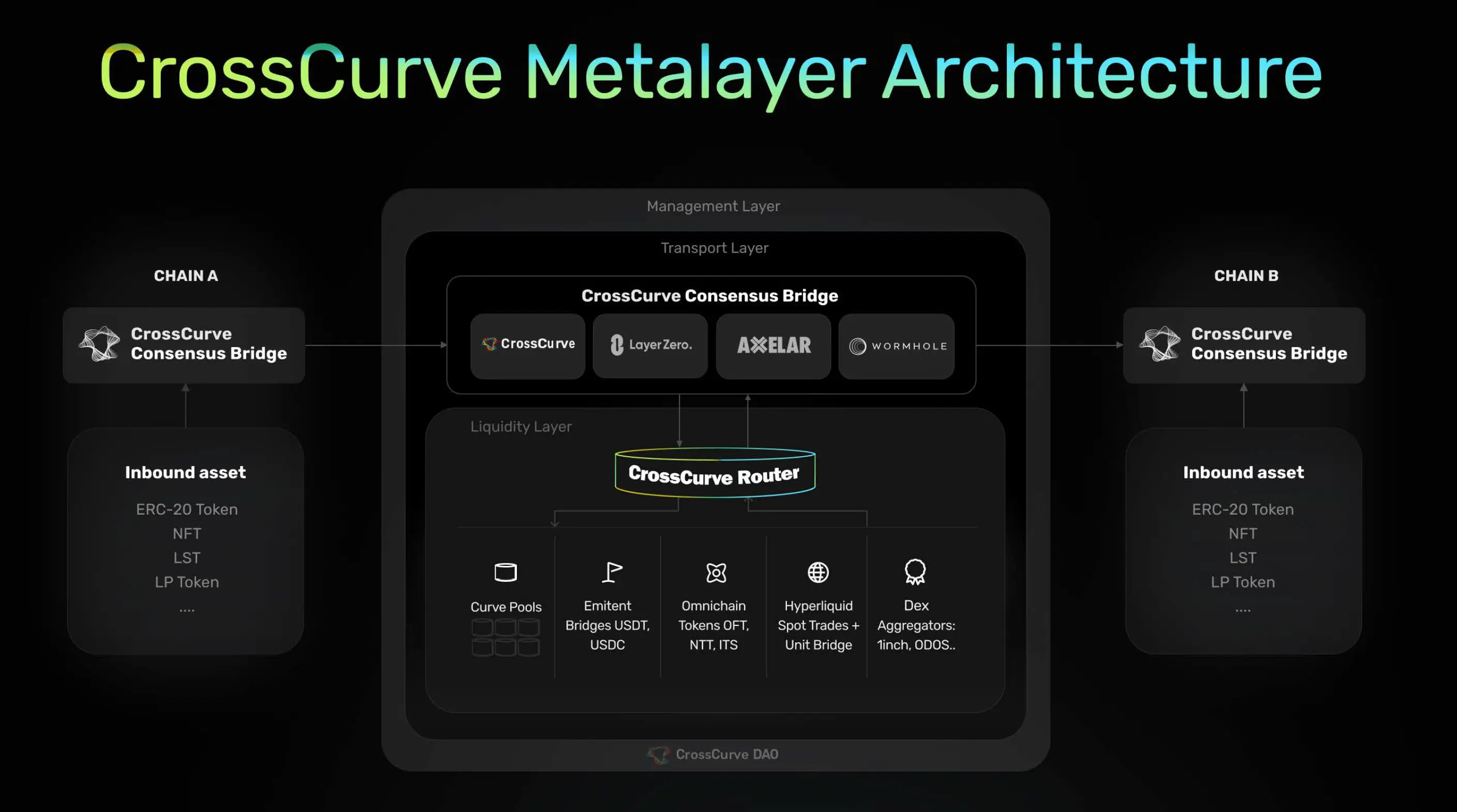

At the heart of CrossCurve is the CrossCurve DAO, where the community drives innovation. Vote on proposals to shape the system, make adjustments, and influence the direction of liquidity pools and rewards. This ensures a transparent and community-driven ecosystem.

Effortless Cross-Chain Asset Transfer

Our Transport Layer enables the smooth and secure transfer of assets between chains with low slippage and minimal delays. With the CrossCurve Consensus Bridge, we leverage industry-leading protocols like Layer Zero, Axelar, and Asterism to ensure safe and efficient inbound and outbound asset movement across chains.

Optimized Liquidity for All Chains

The Liquidity Layer connects a variety of liquidity pools on Curve across different chains, creating a robust and scalable liquidity network. Powered by the CrossCurve Router and HubChain-Sonic, liquidity is optimized and easily accessible for seamless cross-chain transactions on supported blockchains, including ChainA, ChainB, ChainC, and more.

Key Benefits

Security

Industry-leading protection through the combined security of top bridging protocols

Efficiency

Near-zero slippage and minimal gas fees for cost-effective, dollar-for-dollar swaps

Liquidity Access

Instant liquidity across 21 EVM blockchains, including 7 primary networks, 1 hub, and 13 secondary chains

Speed

Transactions settle in seconds — faster than traditional native bridge withdrawals (e.g., to Ethereum)

Purchase of a stablecoin

Purchase of a stablecoin in a network where the consensus bridge is the asset issuer

CrossCurve's seamless cross-chain liquidity flow ensures efficient, secure, and fast asset transfers across multiple blockchains. Starting with the trader's wallet, stable tokens are locked and bridged via CrossCurve's HubChain, utilizing Curve Pools for liquidity. The assets are then transferred and unlocked on the destination chain, ensuring minimal slippage and fast processing, with the final token sent directly to the trader's wallet. This innovative process offers a smooth, transparent, and scalable cross-chain experience for all users.

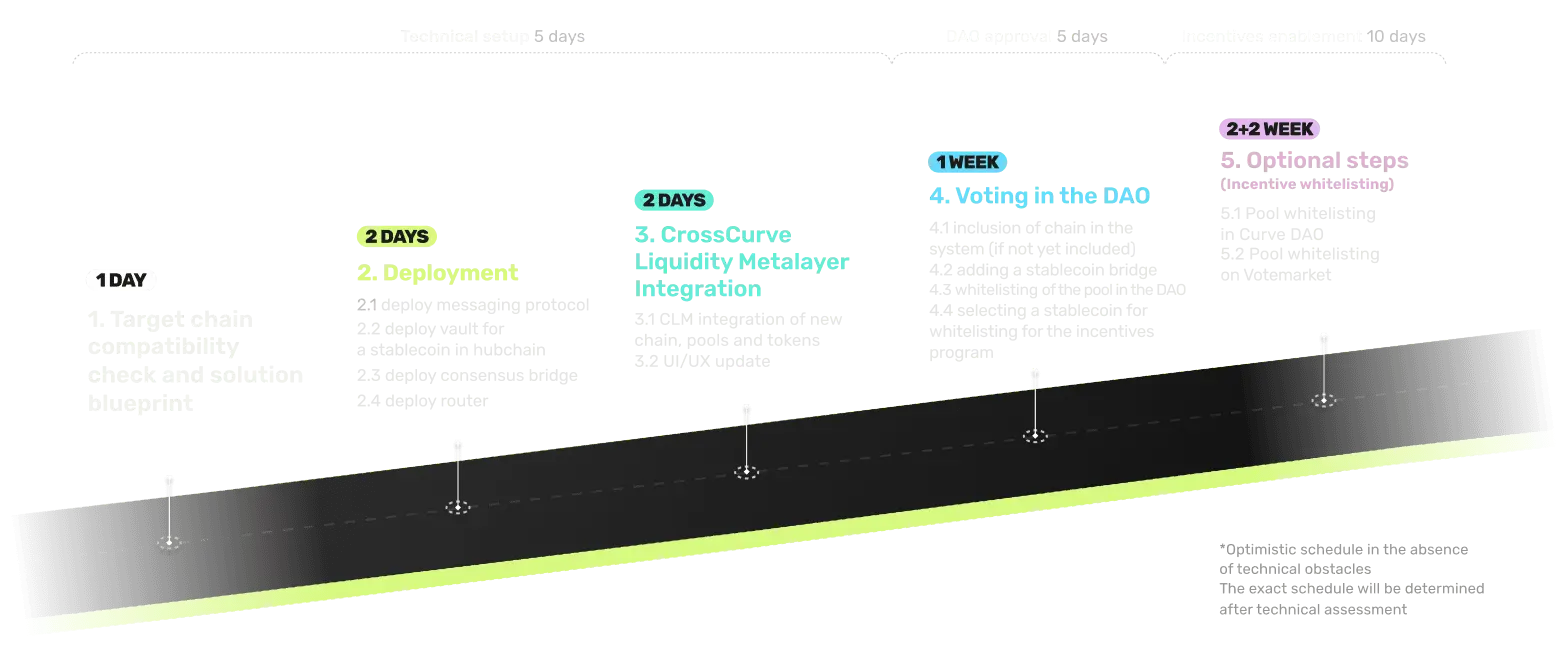

Service delivery timeline

CrossCurve enables seamless and secure cross-chain transfers by bridging assets from any source chain to the destination chain in just a few steps. Starting with the trader's wallet, assets like USDC are locked, processed through the CrossCurve Consensus Bridge, and swapped into derivatives across liquidity pools on HubChain and Arbitrum. The final asset is unlocked on the destination chain, ensuring fast, low-slippage transfers that reach the trader's wallet effortlessly. With CrossCurve, cross-chain liquidity has never been simpler or more efficient.

Unlock Seamless Cross-Chain Liquidity Today!

Experience the future of cross-chain transfers with CrossCurve.