In 2021, some blockchain protocols, such as Avalanche, raised up to $230M in funding. Meanwhile, Solana gained 9160% the same year. One of the major trends this year is the growth of Layer-1 (L1) blockchains and their ecosystems, with Ethereum, the leading smart contract platform, remaining the main driver.

A report by investment bank JPMorgan predicts that the dominance of Ethereum (ETH) in decentralized finance (DeFi) will soon come under threat from other blockchains, unless its expected hard fork comes quickly and it moves to the Proof-of-Stake consensus.

For many who are planning to launch their own blockchain project, the year 2022 is the perfect time to implement blockchain protocols, as 2022 is recognized as the year of protocol tokens.

Protocol tokens are native tokens of a particular blockchain, such as BTC in Bitcoin and ETH in Ethereum. They can exist both on their own blockchain and on any other blockchain in a “wrapped” form. For example, BTC originates from the bitcoin blockchain but can be used on Ethereum as a wrapped ERC20 token – WBTC. In trading, it doesn’t usually matter what blockchain the token is on – its essence is what counts. Protocol tokens can be contrasted with DAO tokens (in a way, they are “shares” in crypto projects), NFT tokens, stablecoins, and others.

What are blockchain protocols?

Charmed by the growth and commercial success of decentralized applications on various blockchains, many companies are now developing blockchains for themselves in order to create a complete ecosystem for their services. A blockchain protocol forms the foundation of the blockchain, ensuring trustless information exchange and defining processes such as validation of transaction integrity and correctness, system security, and allowing nodes to communicate with each other within the network.

In mid-March, the top five L-1 blockchains – in terms of total value locked (TVL) in decentralized finance – controlled over 82% of the $198 billion TVL in the total DeFi market. These 5 blockchains are Polkadot, Terra, Binance Smart Chain, Avalanche and Solana.

In January 2022, the Electric Capital report stated that “Polkadot, Solana, Binance Smart Chain, Avalanche and Terra are growing faster in terms of monthly active developers than Ethereum did at similar points in its history”. These five Layer-1 ecosystems were growing at 250+ monthly active developers each, while Ethreum had been growing at just 100 monthly active developers at similar points in its history, the study specified.

However, Terra’s native token LUNA collapsed on May 13, shedding off 99.9% of its value. Terra has lost its place at the top of blockchain protocols in 2022.

According to OQTACORE, Layer-2 blockchain Polygon should be included in this list. Polygon has hit a new adoption milestone with more than 19,000 decentralized applications (dApps) running on its network, up over 500% from 3,000 dApps in October, according to Alchemy.

The network refers to itself as “Ethereum’s internet of blockchains” because one of its primary missions is to support a multichain Ethereum ecosystem. From 2021, it became the network that served as an interconnection and bridge between blockchains and networks while leveraging Ethereum’s security.

But before we look into the top blockchains, let’s define the features of Layer-1 and Layer-2 protocols, and the prospects for Ethereum as the largest blockchain.

Layer-1 protocols

The fundamental feature of Layer-1 blockchain protocols is that each maintains its own original underlying network and infrastructure and doesn’t use the networks of existing blockchains. Ethereum was not included in the top protocols in our article, but nevertheless it cannot be omitted.

Ethereum is one of the oldest and most established blockchain platforms. It was the first to introduce smart contracts – transactions that can execute a complete program. Ethereum has a rich ecosystem of tools used to create decentralized applications (dApps) and write smart contracts, using programming language Solidity.

The key weaknesses of Ethereum include slow transaction processing (12-15 transactions per second) and higher transaction processing fees compared to other platforms (tens of dollars versus a few cents charged by competitors). In addition to its role as a blockchain platform at the heart of blockchain applications, it has its own cryptocurrency called ether (ETH).

New blockchains have emerged as alternatives to the Ethereum network. Some independent L1 blockchains (BSC, Avalanche) support the Solidity programming language and are EVM-compatible. Others don’t support Solidity and are EVM-incompatible, for example, Terra and Solana.

Ethereum’s competitors are posting faster and cheaper transactions. However, Ethereum is expected to bounce back once it moves from PoW (Proof-of-Work) to the more efficient PoS (Proof-of-Stake) consensus mechanism.

Layer-2 protocols

As transaction fees rise, Layer-1 protocols for DeFi, decentralized games, and NFTs are finding it increasingly difficult to process transactions on-chain (i.e., to write a transaction completely into a block).

Not only Ethereum, but almost all emerging L1 blockchains are having problems – they have difficulty processing large numbers of transactions while maintaining network security and decentralization. Meanwhile, alternative L2 blockchains promise higher scalability and lower fees.

The essence of L2 blockchains is that the full amount of information does not go onto the blockchain; only a hash is stored there to verify that the information stored off-chain is valid. In a sense, you could compare the information on the blockchain to a note that tells the location of a book in a library. The note itself may only contain 10 characters, but the book may be 1,000 pages long. So, it is with the information on the blockchain that takes up just a few dozen bytes that you will be able to know where to find the full transaction data. It also guarantees that all transactions at the specified address were made no later than the specified date (there is no guarantee that they were not made earlier, but we can definitely say that they were not made later; this information is enough for business applications).

This approach greatly reduces the amount of information stored on the blockchain. Indeed, each block can only contain the number of transactions, some ID and hash of the block, while the block itself can be stored elsewhere. This means the network can encrypt 1,000, 100,000, or much more transactions, taking up just a little space. The fee for one transaction is divided between all L2 transactions in that block.

5 key blockchain protocols

#5 Polkadot

DOT – #13 in the CoinMarketCap ranking (May 2022).

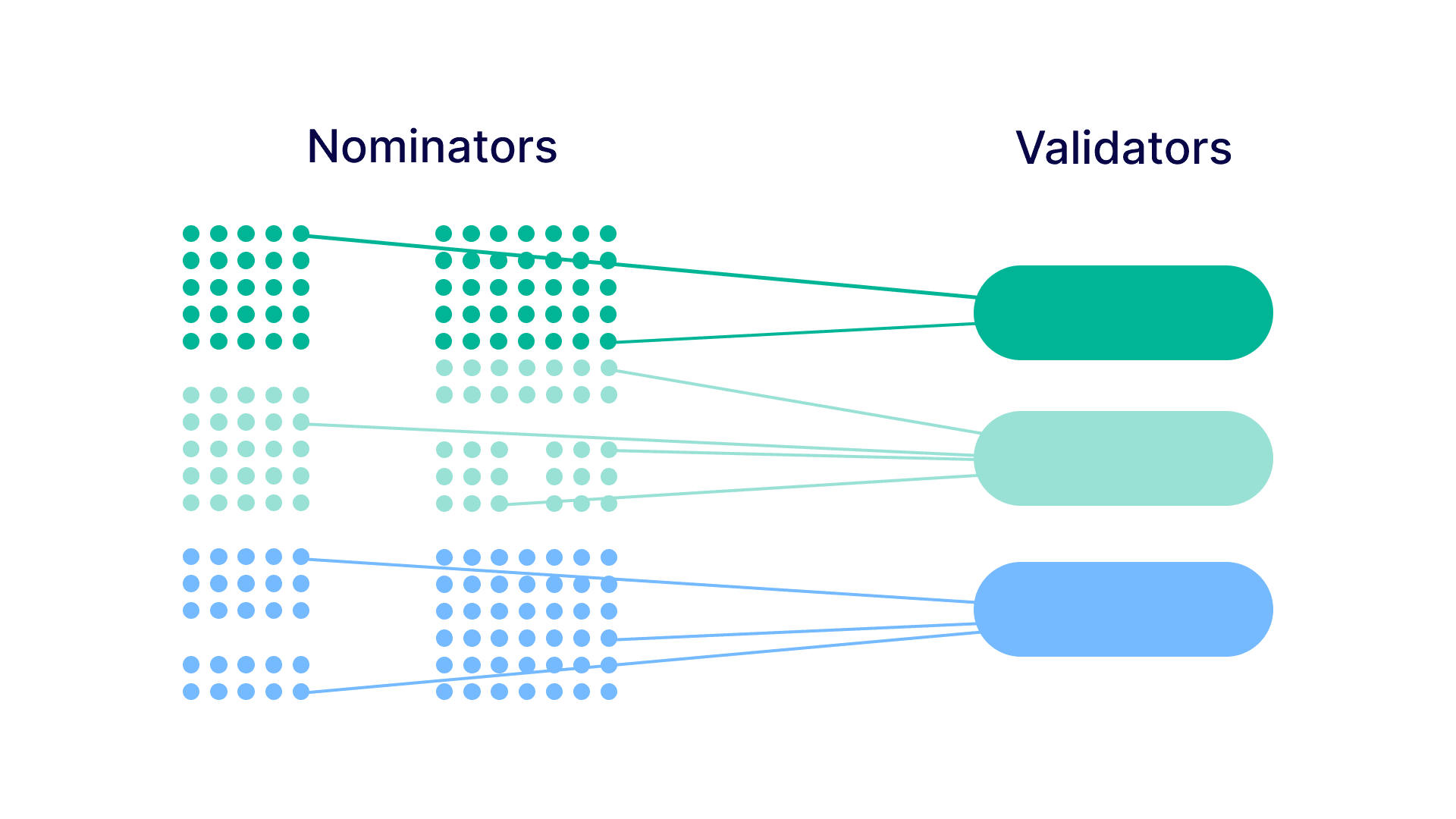

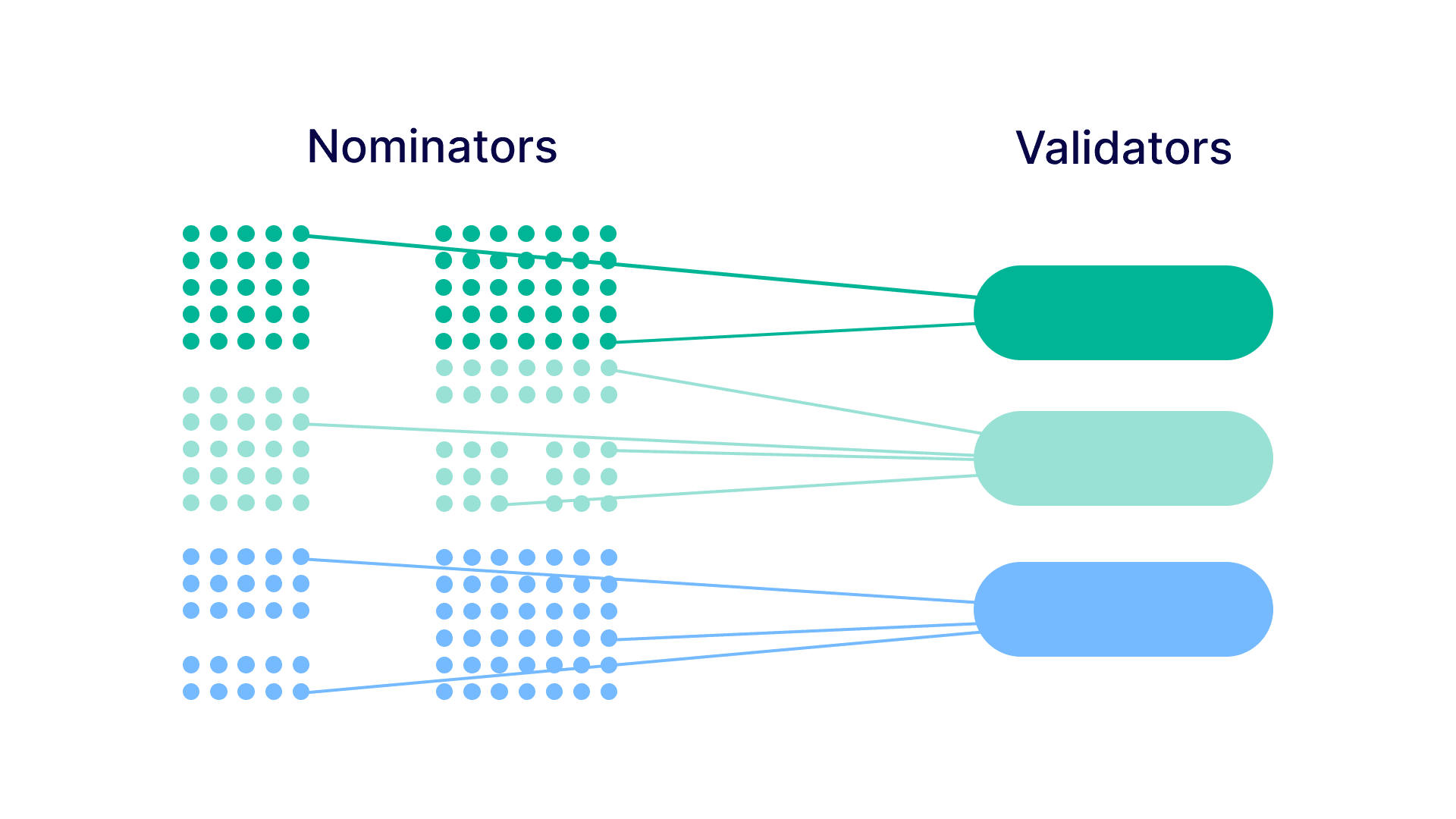

Consensus mechanism: NPoS. This protocol was inspired by the sequential Phragmen method that optimizes elections where there are many candidates and multiple winners. This is to maximize the diversity of representation, such as in a parliament, and avoid having members of only the single largest party there. The same algorithm formed the basis for NPoS, where decentralization and fair representation are ensured.

How are validators elected, taking into account the votes of all nominators? Unlike other PoS-based projects, where validators are weighted by stake, Polkadot gives elected validators an equal say in the consensus protocol.

Average block time: 6 sec.

Average transaction fee: weight-based, with simple money transfer transaction costing about $0.10-0.20. Transactions on the Polkadot network support the transaction weight model instead of the usual gas model. The weight-based model is very similar to the gas model, but in Ethereum the required amount of gas is only known at the end of transaction (and it can happen that you didn’t pay for enough gas and the transaction gets cancelled without refund due to insufficient gas), while in Polkadot you know the required transaction fee upfront.

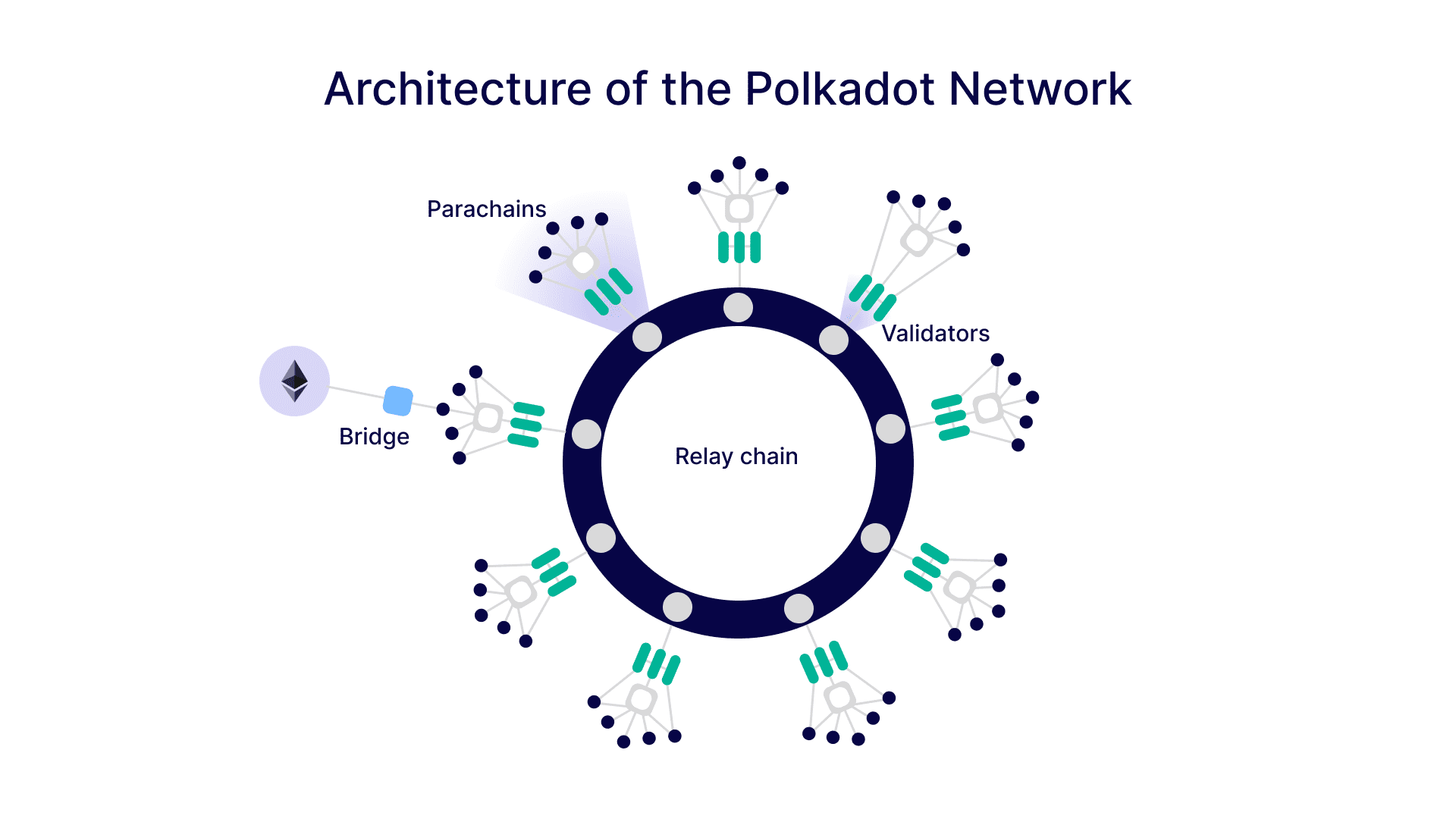

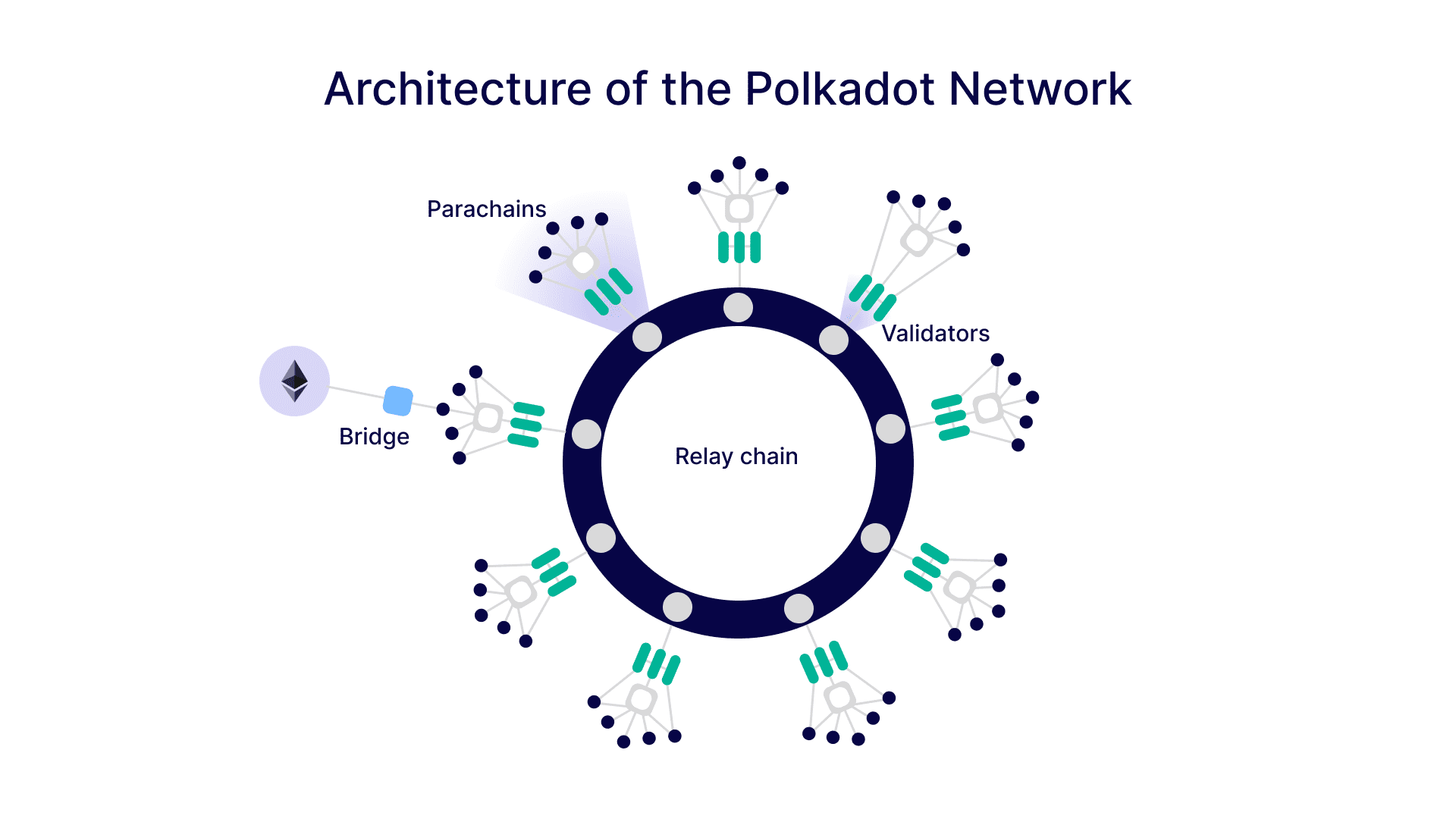

Polkadot is an interoperable “chain of chains” or “Layer 0”, “meta-protocol,” as its creators call it. Currently, it supports an estimated 100 to 250 parachains, which compete to provide processing power for its main chain. The upper bound on the number of parachains is defined by complexity and cost af scaling Polkadot’s XCMP (Cross-Chain Message Passing) protocol to each new parachain. And keeping in mind that each parachain is unique with its own performance and features, any estimation of cap on the number of parachains is purely theoretical. Another important factor is the number of validators – Polkadot seeks to maintain an optimal ratio (at least 10:1) of validators to parachains to support decentralization and performance.

Parachains are blockchains of Polkadot Network members running in parallel, which connect to the main relay chain if they get such a right through a special parachain slot auction. Polkadot is attractive for several reasons. For example, though it’s slower (at the moment, due to insufficient number of connected parachains), it is more predictable in the future in terms of transaction speed and fee, especially if we talk about Polkadot in a few years when it gets filled with parachains up to its full capacity.

Another advantage of Polkadot is its additional proof to 51% attack. Polkadot introduces a concept of shared security, when an attacker cannot hijack 51% of just one parachain, but needs to hijack every single parachain connected to the Polkadot’s relay chain, which makes the task much much harder.

Polkadot network architecture. How parachains and consensus work in the Polkadot ecosystem.

#4 Avalanche

AVAX – #12 in the current CoinMarketCap ranking (May 2022).

Consensus mechanism: Snowball algorithm. A very good explanation from Avalanche:

`Imagine a room full of people trying to agree on what to get for lunch. Suppose it’s a binary choice between pizza and barbecue. Some people might initially prefer pizza while others initially prefer barbecue. Ultimately, though, everyone’s goal is to achieve consensus.

Everyone asks a random subset of the people in the room what their lunch preference is. If more than half say pizza, the person thinks, “Ok, looks like things are leaning toward pizza. I prefer pizza now.” That is, they adopt the preference of the majority. Similarly, if a majority say barbecue, the person adopts barbecue as their preference.

Everyone repeats this process. Each round, more and more people have the same preference. This is because the more people that prefer an option, the more likely someone is to receive a majority reply and adopt that option as their preference. After enough rounds, they reach consensus and decide on one option, which everyone prefers`.

Average block time: 2 sec.

Average transaction fee: <$1.0

Protocols in the Avalanche family operate through repeated sub-sampled voting. When a validator is determining whether to accept or reject a transaction, it asks a small random subset of validators whether they believe the transaction should be approved or refused.

Avalanche is an open-source platform developed by Ava Labs. It allows anyone to deploy DeFi applications and individual blockchains in a single scalable ecosystem. Avalanche can be described as a “platform of platforms”, consisting of thousands of subnets to form a single interoperable network.

As a part of popularizing this concept, the Avalanche Foundation has launched Avalanche Multiverse, an up to $290M (up to 4M AVAX) incentive program focused on accelerating the adoption and growth of its “subnet” functionality, which enables a rich ecosystem of scalable app-specific blockchains. Initially, the program is focused on supporting new ecosystems including, but not limited to, blockchain-enabled gaming, DeFi, NFTs and institutional use cases.

Avax is targeting to get many Ethereum dApps migrated to it, so it supports Solidity smart-contracts out of the box and even provides a walkthrough of deploying a typical Ethereum smart-contract on Avalanche.

Protocols in the Avalanche family are very fast. The developers claim that it can process over 4,500 transactions per second, which corresponds to Visa’s typical throughput.

While Polkadot has a limit on the number of parachains that can be auctioned off, Avalanche boasts an unlimited number of compatible blockchains, with a stipulated fee of 1 AVAX per blockchain connection. Avalanche’s moderate transaction fee opens up a favorable ecosystem for players who wish to transact in the DeFi marketplace.

#3 Solana

SOL – #12 in the CoinMarketCap ranking (May 2022).

Consensus mechanism: Proof-of-History (PoH) is a time validation mechanism in which there is a single source of truth in the network, producing values that cannot be predicted in advance, but are easily verified after a given point in time. This can be compared to news – if you receive an email with a link to a news article, you know that it couldn’t have been sent before the article was published. For example, you can use data from the exchange as a central source of truth. With this approach, blockchain participants don’t have to negotiate with each other every second like in other blockchains. This removes the need to check timestamps when verifying transactions and greatly increases blockchain speed.

Average block time: 0.4 to 0.8 sec.

Average transaction fee: $0.00025

Solana seems to be firmly entrenched in the top 15 cryptocurrencies by market cap (~$30 billion), surpassing Polkadot (~$20 billion) and Avalanche (~$25 billion). What other strengths of Solana can be highlighted?

The Solana testnet, featuring a network of 200 physically distinct nodes, supports a sustained throughput of 50,000 transactions per second (tps) when running with GPUs.

Solana’s Proof-of-History (PoH) protocol aims to increase transaction processing speed and security. Source: Blockwork

The PoH protocol allows the blockchain network to scale in accordance with Moore’s law by just increasing the hardware power.

#2 Polygon

MATIC– #19 in the CoinMarketCap ranking (May 2022).

Consensus mechanism: Proof-of-Stake – PoS.

Polygon is built on top of the Ethereum network and tackles its lack of efficiency and scalability that go far behind its usage growth. Polygon is a Layer-2 scaling solution for Ethereum that has managed to become one of the most popular solutions for blockchain applications across all blockchains, not only Ethereum, thanks to a faster, cheaper and more scalable network. Polygon is extremely compatible with the Ethereum network, and any Ethereum user or developer can switch from Ethereum to Polygon effortlessly

Average block time: 2 to 3 sec.

Average transaction fee: $0.002

As Polygon is an Ethereum-compatible chain, it has attracted a large number of projects originally based on Ethereum to integrate its blockchain. Polygon has become very attractive for some of the biggest Web3 platforms and developers because of the many scaling options and low transaction fees it offers.

Several top projects like Aave and Curve launched on Polygon last year. Moreover, it has been chosen by many metaverses, for example Decentraland, for scaling. Some decentralized crypto exchanges like UniSwap and SushiSwap have also launched on Polygon, enabling their users to trade tokens without intermediaries.

Many projects are built exclusively on Polygon. Data from Alchemy shows that 55% of projects are built solely on Polygon, and another 45% have chosen to also support Ethereum.

On May 27, Tether, the largest stablecoin by market cap (over US $73 billion), launched its tokens (“USD₮”) on Polygon.

Polygon can rightfully be considered a strong competitor to Layer 1 protocols and promising for implementation of your project within the network.

#1 Binance Smart Chain (BSC)

BNB – #5 in the CoinMarketCap ranking (May 2022).

Consensus mechanism: Proof of Staked Authority (PoSA) is a combination of Delegated Proof of stake (DPoS) and Proof of Authority (PoA). The conventional Proof-of-Stake consensus is when blocks are validated by the network members themselves, who have staked their own funds. In the delegated version, some delegates are chosen from all the stakeholders (in the case of BSC there are 21 delegates).

Then, PoA describes how those delegates are selected. PoA is a model where delegates are selected in a centralized manner (compare to Polkadot’s NPoS where delegates are voted for in a decentralized way). In the BSC, Binance itself is responsible for this, selecting only those delegates that have passed through the KYC (Know Your Client) process. This boosts network centralization, but in the meantime gives more compatibility with government institutions, as well as increases transaction processing speed (centralized processing does not require time for the network to reach consensus).

Average block time: 3 sec.

Average transaction fee: $0.34

One of the biggest BSC users is Binance itself – and keep in mind, it is also one of the biggest players in the crypto space in general. Binance uses and develops BSC as the basis for its own centralized crypto-exchange (CEX) and cryptocurrency wallet. A blockchain designed to solve (and is successfully solving) such complex problems deserves the closest attention. Moreover, this blockchain is number 5 in the CoinMarketCap ranking (May 2022), with a $50 billion market cap.

Binance Smart Chain was developed as an extension of Binance Chain when it was discovered that Binance Chain could not provide an optimal user experience due to lack of smart-contracts. The newly developed EVM-compatible BSC allows developers to move their projects from Ethereum to BSC to reap the benefits of the blockchain speed.

Binance Smart Chain has low transaction fees (a few tens of cents). In addition, gas prices on BSC are relatively constant due to the large network bandwidth and as a consequence, there are no queue overflow periods for pending transactions.

How the BSC ecosystem works. Source: Binance

Blockchain protocols remain in the spotlight

Ethereum is currently the leading platform for creating and deploying smart contracts. But due to the rapid rise in ETH price, transaction fees have also risen to unacceptable levels. Honestly speaking, this is not just a problem for ETH – network congestion is an obstacle for all blockchains seeking to scale to billions of users. This is associated with a key feature of blockchain in general – data cannot be deleted from it, its volume only grows every day, making the blockchain clumsier and harder to work with.

However, there are continuing attempts and efforts towards inventing an ideal blockchain. Against the backdrop of Ethereum’s emerging dApp crisis due to unacceptably high transaction fees, a window of opportunity has opened up for new players; modern blockchains are rushing to offer more productive and load-resistant protocols:

| Blockchain | Currency | Market capitalization | Consensus mechanism | Average block time | Average transaction fee |

| Solana | SOL | $28.7 billion | PoH | 0.4-0.8 sec. | $0.00025/p.t |

| Binance Smart Chain (BSC) | BNB | $64.6 billion | PoSA | 3 sec. | $0.34/p.t |

| Polkadot | DOT | $18.6 billion | NPoS | 6 sec. | $0.1-0.2 |

| Avalanche | AVAX | $23.7 billion | Avalanche consensus (Snowball algorithm) | 2 sec. | <$1,0/p.t |

| Polygon | MATIC | $5.04 billion | PoS | 2-3 sec. | $0.002 p.t |

If you’re planning a blockchain project, the protocols presented in this review will serve as a reliable solution for a wide range of purposes. OQTACORE has extensive experience in blockchain development. Our experts also provide comprehensive support to blockchain products to make them productive and useful for every end user.