Learn how you can leverage this Restaking concept today!

As DeFi grows, it is more important than ever to make the most of your crypto assets and increase decentralization. Imagine if your staked crypto could do double duty—work in multiple places at once, ensuring security and generating additional returns.

With Restaking, this is becoming a reality. That is what the Restaking narrative is all about. Let’s start…

What is Restaking?

Restaking is a new narrative in the crypto world that allows the reuse of staked assets to create a shared security economy. Usually, when you stake your tokens, they help to secure one blockchain network, and you earn rewards from that network. But with restaking, you can use those same staked tokens to secure multiple blockchain protocols simultaneously.

This leads to better use of your assets and the potential to earn more rewards compared to traditional staking methods.

Imagine you have a piece of land. You could just plant a lawn and enjoy life. Or, instead of a lawn, you could make the most of the land by planting a lush garden and installing solar panels and a wind turbine to generate electricity for your home and electric car. That way, you can make the best use of the resource.

Think of it as putting your money to work hard; it might ask for a vacation!

Restaking has quickly become a major trend in DeFi in 2024. It has accumulated a Total Value Locked of $26+ billion, making it the fourth largest trend in DeFi. At its highest point, restaking reached a TVL of $29 billion. These numbers show that many people trust and are interested in this new approach.

Source: DefiLlama

While restaking is innovative in crypto, the basic idea comes from traditional finance. In the past, similar concepts were used in financial products like synthetic Collateralized Debt Obligations or CDOs. Unfortunately, misuse of CDOs contributed to the 2008 financial crisis. However, the key difference is that restaking is designed to be more transparent and secure in the crypto space.

By learning from past financial ideas and improving them, restaking aims to build a more connected and efficient DeFi ecosystem that benefits everyone involved.

The Development History of Restaking

Restaking didn’t just appear out of nowhere; it was created to solve specific problems in decentralized finance (DeFi).

Two main issues pushed developers to come up with restaking are:

- Low capital Efficiency: especially noticeable with Ethereum’s liquid staking derivatives. This means that the way assets were used wasn’t as effective as it could be;

- High Complexity and Costs in Building Security Projects: Developing new blockchain projects was hard and expensive for projects that didn’t fit neatly within Ethereum’s scaling methods.

To understand restaking better, let’s dive into these challenges.

Liquid staking and its limitations

For a long time, early blockchains like Bitcoin used the consensus algorithm called Proof of Work, or PoW, to verify transactions. PoW was often criticized because it used a lot of energy and wasn’t very efficient.

In September 2022, Ethereum made a big change by switching to Proof of Stake (PoS). In PoS, people called validators stake lock up 32 ETH to help verify new blocks and transactions. If they do their job correctly, they are rewarded. But if they act dishonestly or make mistakes, they can lose some of their staked ETH – a penalty known as slashing.

However, staking 32 ETH is a lot of money at the current exchange rate, too much for many individual investors. To solve this problem, platforms like Lido and Rocket Pool created staking pools. These pools allow many people to combine their smaller amounts of ETH to reach the required sum. When you stake your ETH in these pools, you receive something called a Liquid Staking Derivative (LSD). This LSD represents your staked ETH at a 1:1 ratio.

What’s great about LSDs is that they are liquid, meaning you can still use them while your ETH is staked. For example, you can:

- Use LSDs as Collateral: You can borrow other assets by using your LSDs as security;

- Provide Liquidity on Decentralized Exchanges (DEX): You can pair your LSDs with ETH in liquidity pools on platforms like Uniswap, earning fees from trades;

- Just sell them! Imagine you had a deposit at a bank, and you could sell it at any given time for the total deposit principal plus accumulated APR.

While this system improved the effective use of assets and capital efficiency, it also introduced new risks:

- The first one is the risk of Centralization Concerns: By January 2023, Lido controlled 76% of the ETH liquid staking market. This means one platform had a lot of control, which goes against the decentralized nature of blockchain;

- The second is Potential for Censorship: With so much control, there’s a risk that transactions could be censored at the protocol level;

- The third is the risk of Locked Assets: A large amount of ETH was locked up in staking contracts, which meant it wasn’t being used elsewhere in the DeFi ecosystem.

The Complexity of Scaling

Understanding modular blockchains is the key to grasping how restaking developed. Let’s break down the four main functions that any blockchain needs to perform:

- Consensus Layer: This is how all the nodes (computers) in the network agree on the order of transactions.

- Execution Layer: This involves processing and executing transactions correctly.

- Data Availability or DA Layer: Ensuring that transaction data is stored and accessible to everyone who needs it.

- Settlement Layer: Providing final confirmation of transactions and handling any disputes.

In traditional or “monolithic” blockchains, all these functions happen within one system. While this can be secure, it often leads to problems with scalability, handling more transactions, and decentralization; this issue is known as the blockchain trilemma, which suggests that a blockchain can only have two out of the three qualities: decentralization, security, and scalability.

To solve this problem, developers came up with the idea of modular blockchains. Instead of handling everything in one place, modular blockchains split these functions into separate layers or modules. Each module specializes in one function but can still interact with the others. This approach allows for:

- Specialization: Modules can optimize for their specific tasks.

- Flexibility: Developers can mix and match modules to suit their needs.

- Shared Security: Validators can secure multiple layers or protocols, which is where restaking comes in.

By separating the core functions, modular blockchains make it possible for validators to be economically incentivized to secure multiple protocols at the same time. This shared security is essentially the idea behind restaking.

Early Examples of Restaking

One of the first real-world examples of a modular blockchain is Celestia. Celestia separates consensus and data availability from execution. This means developers can create specialized blockchains (rollups) that use Celestia’s consensus and data availability layers. They don’t need to set up their validators because they can rely on Celestia’s existing validator network. This approach reduces costs: Developers don’t need to invest in their security infrastructure. Also, this approach improves scalability: By offloading certain functions to Celestia, their chains can run more efficiently. Last, this approach allows Celestia’s Native Token $TIA to be used for security and resource allocation.

However, Celestia isn’t fully compatible with the Ethereum Virtual Machine and operates within the Cosmos ecosystem, which limits its applicability to projects built on Ethereum.

Around the same time, EigenLayer emerged with a similar idea but focused on the Ethereum ecosystem, and in fact, it was the first staking protocol. Eigenlayer allows validators to “restake” their ETH or liquid staking derivatives to secure additional services known as Actively Validated Services. By leveraging Ethereum’s robust security framework, EigenLayer extends its trust model to AVS, enabling these networks to benefit from Ethereum’s validator set without having to bootstrap their own security. This dramatically increased the capital efficiency and security of projects building on Ethereum and beyond, effectively expanding the security guarantees provided by Ethereum’s layer-1.

Restaking mechanism (using EigenLayer as an example)

Before we dive into how restaking works, let’s firstly look at how EigenLayer is set up.

EigenLayer has four main parts:

- Part One: Stakers. These are users who stake (lock up) their Ethereum or Liquid Staking Tokens or LSTs like stETH or rETH. By staking, they earn rewards and help secure multiple services at once;

- Part two: Operators. These are validators who keep the network secure. They validate transactions for additional services;

- Part three: Actively Validated Services. These are projects that use restaking to benefit from Ethereum’s network of validators, which adds security to their operations without them needing their own validators;

- Part four: Main EigenLayer Contract. Think of this as the central program that manages everything. It oversees how stakers delegate their assets, sets the rules for penalties, called slashing, and controls how rewards are given out to both stakers and operators.

Step-by-Step Process

Here’s how restaking works with EigenLayer:

- Staking: Users stake their ETH or LSTs in the EigenLayer contract. This means their staked tokens now help secure not just Ethereum but also the additional AVSs.

- Delegation: Stakers assign (delegate) their staked tokens to validators.

- Operator Registration: Validators sign up as operators. This allows them to take on extra tasks for the AVSs, extending security services beyond just Ethereum.

- Validation: Operators check and confirm transactions for the AVSs. Each AVS sets its own rules for how this should be done, including what happens if operators don’t do their job correctly (slashing rules) and how decisions are made (quorum settings). This means each AVS can customize its security needs.

- Slashing & Veto: If operators fail to perform their duties, they can be penalized through slashing, which means losing some of their staked tokens. EigenLayer also has a Veto Slashing Committee or VSC that can overturn slashing decisions if necessary. Each AVS can create its own VSC, allowing flexible and competitive ways to manage penalties.

The Current state of EigenLayer

Source: DefiLlama

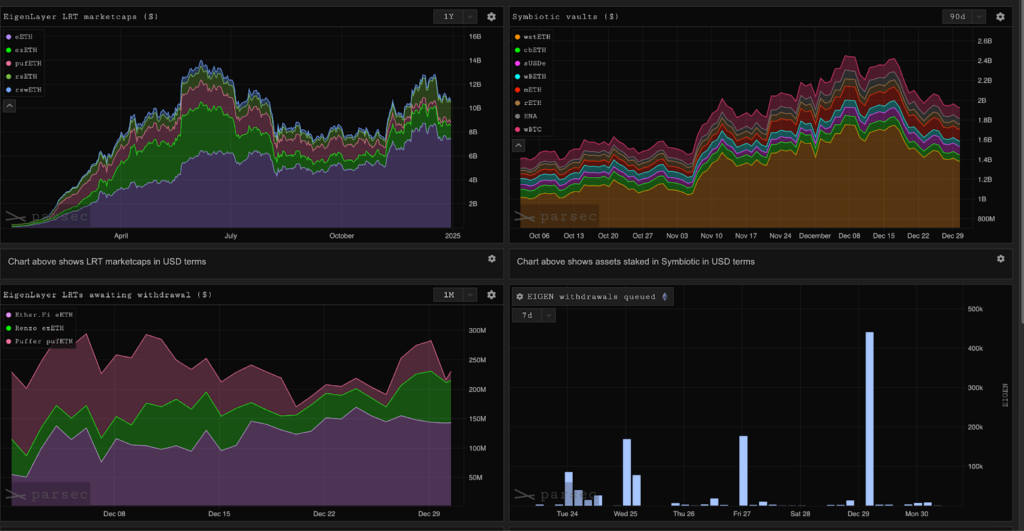

Here are the key figures for the current state of EigenLayer, based on recent reports:

Company Valuation:

Fully diluted market valuation: $6.5 billion.

Total Value Locked (TVL):

Total locked assets: $16,7 billion (Dec. 2024), positioning EigenLayer among the top DeFi projects by TVL.

User Activity:

- Before token launch: Over 173,000 active addresses.

- After token launch: Fewer than 4,000 active addresses, indicating a decline in engagement.

Number of Actively Validated Services (AVS):

Around 15 AVS are currently active on the platform, leveraging the restaking mechanism.

Annual Yield for Stakers:

Approximately 5–15%, varying by the type of AVS, which is lower than anticipated due to high competition among validators.

Source: ParSec

Current Restaking ecosystem

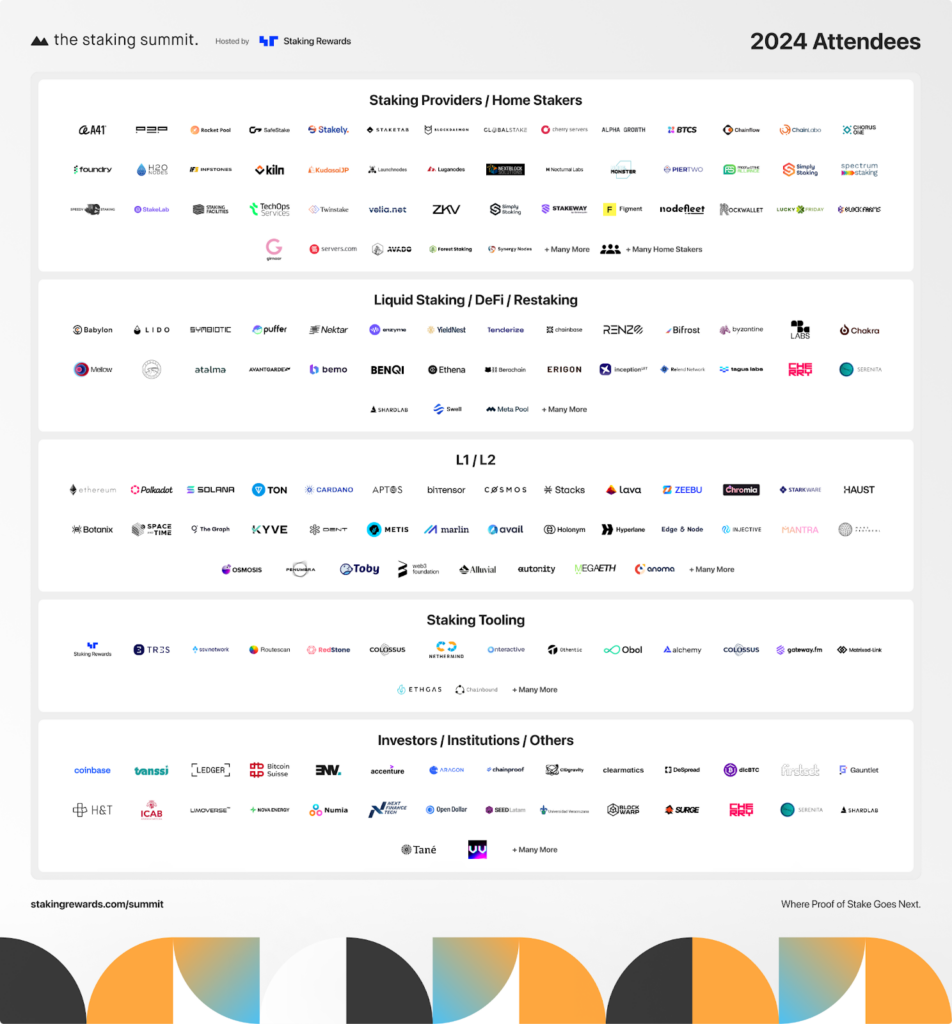

EigenLayer has inspired developers to create a whole ecosystem of different restaking solutions. Let’s take a look at some of the more interesting ones.

Symbiotic

Symbiotic is a restaking protocol built on Ethereum. It acts as a coordination layer that allows network builders to customize and manage their restaking setups in an open environment where anyone can participate permissionless. It gives participants more control over important settings such as:

- Selecting node operators

- Assigning collateral

- Deciding how rewards are distributed

- Setting slashing policies

This means Symbiotic offers more flexibility than EigenLayer.

The project uses ERC-20 tokens and vaults to assign collateral to network operators who manage infrastructure.

Additionally, in Symbiotic, ‘resolvers’ are responsible for validating or vetoing slashing events (penalties), adding a decentralized governance component that is more customizable compared to EigenLayer’s relatively centralized Veto Slashing Committee.

Symbiotic’s design minimizes the need for trust in a central authority and is built to support a wide range of networks. This allows developers to adopt a modular and adaptable approach to restaking. In contrast, EigenLayer focuses on expanding Ethereum’s validator set with more standardized configurations. So, Symbiotic offers a more customizable and decentralized alternative, enhancing the potential for innovation and tailored security across networks.

Babylon

Babylon is a restaking protocol that uses the security of Bitcoin’s proof-of-work (PoW) system to enhance the security of proof-of-stake (PoS) chains through its own Babylon chain, built using the Cosmos SDK. We have a separate video about Cosmos SDK on our Youtube channel that we recommend you to watch.

This integration allows PoS networks to leverage Bitcoin’s strong and censorship-resistant blockchain without needing to create their own validator sets. It offers a hybrid model that combines Bitcoin’s resilience with the efficiency of PoS systems, including lower energy use and faster transaction confirmations.

By connecting PoS chains to Bitcoin’s established security, Babylon provides a compelling way to scale and innovate without requiring each network to build its own security from scratch. Babylon allows Bitcoin stakers to bring their PoW security to PoS networks. While EigenLayer enhances security within the Ethereum ecosystem by relying on Ethereum’s validators, Babylon leverages Bitcoin’s network. It connects it to PoS chains in the Cosmos ecosystem, offering a solution that works across different blockchain systems.

Solayer

Solayer is a restaking protocol built on the Solana blockchain. It leverages Solana’s high-speed and low-cost performance to secure both native Solana applications and external services, with a particular focus on Solana’s own dApps. Validators can restake their assets to secure various decentralized services, optimizing Solana’s Proof-of-History and Tower BFT consensus mechanisms to achieve high performance and scalability. This makes Solayer ideal for applications that need speed and low transaction costs, aligning well with Solana’s strengths.

The project integrates seamlessly with Solana’s system, allowing easy interaction between native dApps and the validation infrastructure. Validators restake their assets into validator-specific vaults, which secure different decentralized services on Solana and across other chains. This setup provides strong security and scalability, enabling developers to utilize Solana’s infrastructure for various purposes fully.

Jito

Jito is another restaking protocol built on Solana, focusing on flexible staking and liquidity management through liquid restaking tokens and customizable slashing conditions. Its design allows validators and stakeholders to manage risk and rewards dynamically, enhancing economic security while keeping liquidity available for DeFi. Using Solana’s high-speed capabilities, Jito is especially suited for high-frequency trading and other fast-paced applications.

Jito’s infrastructure supports various staking strategies, where validators can restake assets to multiple services while adjusting slashing conditions to their specific needs. The protocol’s VRTs allow users to stake their assets while still keeping them liquid, offering efficient use of capital.

Mind Network

Mind Network is the first restaking layer that uses Fully Homomorphic Encryption FHE and is designed for AI and Proof-of-Stake PoS networks. We’ve mentioned this project in our FHEML article, so be sure to check it out.

Mind Network accepts restaked tokens from ETH, BTC, and AI assets, operating as an FHE validation network to ensure consensus, data integrity, and cryptoeconomic security for decentralized AI, DePIN AVS, and several important PoS systems. By using FHE, Mind Network addresses the specific security needs of AI networks, protecting high-value and sensitive data in a decentralized environment.

Pros and cons of Restaking

Restaking is a powerful tool that maximizes the use of staked assets and improves security. However, it brings complexities and risks that need careful consideration to maintain decentralization. Let’s take a closer look:

Pros:

- Enhanced Capital Efficiency: Restaking allows you to make the most of your staked assets. You can earn income from multiple sources by securing more than one service with the same tokens, which strengthens financial incentives;

- Shared Security: Different protocols can share the same group of validators the people or entities that confirm transactions, providing strong security without each protocol needing to build its own separate security system;

- Improved Development Process: Restaking can speed up and simplify the development of new crypto projects. Developers can focus on building their products rather than dealing with complex technical security setups.

Cons:

- Increased Complexity: Managing restaked assets across multiple networks adds technical challenges. Validators need advanced systems to handle different penalty rules called slashing conditions and governance requirements for each network;

- Compounded Risk: There’s a risk called “cross-protocol slashing,” if something goes wrong on one network, validators could be penalized on all networks they are securing. This means a problem in one place can affect everything else;

- Risk of Overusing the Same Assets: When you restake, you’re using the same staked assets across multiple networks simultaneously, which can maximize their utility but also introduces risk. If one network fails or is compromised, it can negatively affect all other networks that rely on those same assets because they’re all interconnected through your shared stakes.

The Future of Restaking

Restaking is set to reshape the DeFi world, extending economic security beyond a wider range of projects. As early as 2025, restaking could become a standard feature, offering better incentives and multiple layers of security. Almost every market segment could potentially benefit from restaking:

- Tokenizing Real-World Assets (RWA): Restaking can secure digital versions of real-world assets by preventing double-spending and tampering with ownership records on the blockchain.

- Decentralized Social Media: Restaked assets can improve content control and moderation on decentralized social platforms, reducing censorship and spam through penalty mechanisms.

- Decentralized Content Sharing: Restaking can secure content-sharing platforms, encouraging honesty and reliable access while penalizing malicious actors.

- Crypto Gambling Platforms: Validators using restaking can ensure fair and secure management of bets and payouts, boosting user confidence in crypto gambling.

- Blockchain Gaming Platforms: Restaked assets can support blockchain games by securing transactions, ensuring fair trades, and protecting in-game assets with penalties to prevent cheating.

- Cross-Chain dApps: Restaking could provide a unified security layer for decentralized apps operating across multiple blockchains, making cross-chain transactions simpler and more secure.

- Blockchain Analytics Platforms: Restaked collateral can ensure the accuracy and reliability of on-chain data collection and processing, making blockchain analytics tamper-proof.

- Open AI Networks and Agents: Restaking protocols can incentivize AI networks by ensuring data security and computational accuracy and penalizing errors, such as AI making up facts.

- Privacy Networks and Public Services: Restaked assets could provide the infrastructure and financial incentives for decentralized services like privacy networks, API providers, and public goods platforms.

Conclusion

Restaking protocols are revolutionizing blockchain security by allowing validators to extend their influence beyond their original networks and enhancing asset efficiency. These protocols offer innovative ways to boost yield and security, creating new opportunities for decentralized services. As restaking grows, the focus will be on building resilience, ensuring that protocols develop robust frameworks to manage risks and optimize performance.

While many see restaking as a promising investment and a significant advancement in crypto security, others remain cautious, viewing it as risky. Its stability is untested in extreme market conditions like a “Bear Market.” But hey, in the crypto world, are you even investing if you’re not occasionally wrestling a bear?

Despite these concerns, this evolution will enable the restaking ecosystem to mature and become a core component of decentralized finance, fostering more inclusive and interconnected blockchain networks. Restaking holds immense potential for reshaping how assets are secured and utilized.

We’ll continue to monitor the latest news and insights in DeFi and AI.