The buzz around Real-World Assets (RWA) within the cryptocurrency sphere is becoming increasingly palpable. With industries ranging from real estate to the stock market, and even to environmental sustainability efforts like carbon credits, stepping into the limelight, the concept of tokenizing tangible assets has sparked a conversation worth paying attention to. This innovative approach promises to redefine the boundaries of investment, making it more accessible, secure, and transparent than ever before. But the burning question remains: Can the tokenization of real-world assets truly transcend its current niche status to become a staple in the investment portfolios of the average individual? This article delves into the heart of RWA tokenization, exploring its potential to revolutionize the cryptocurrency landscape and perhaps, the global economy at large.

What is Asset Tokenization?

Asset tokenization, particularly within the cryptocurrency industry, is a transformative process where Real-World Assets (RWA)—those not initially part of the blockchain—are converted into digital tokens. These assets range from tangible ones like oil, gold, and real estate to electronically issued assets such as bonds, carbon credits, and ETFs (Exchange Traded Funds).

RWA protocols are essentially the projects at the forefront of this innovation. They employ blockchain technology to tokenize these real-world assets, encapsulating them either in traditional token formats or as more unique forms like NFTs (Non-Fungible Tokens) and SFTs (Semi-Fungible Tokens). This process bridges the gap between the physical and digital worlds, offering a new realm of possibilities for asset management and investment in the crypto space.

RWA Market Overview

The Real-World Assets (RWA) sector within the cryptocurrency market is experiencing substantial growth, demonstrating a dynamic shift in how traditional assets are viewed and utilized in the digital age. Based on recent data and analysis, the evolution of this market segment is noteworthy for several reasons:

Total Value Locked (TVL) in RWA Platforms

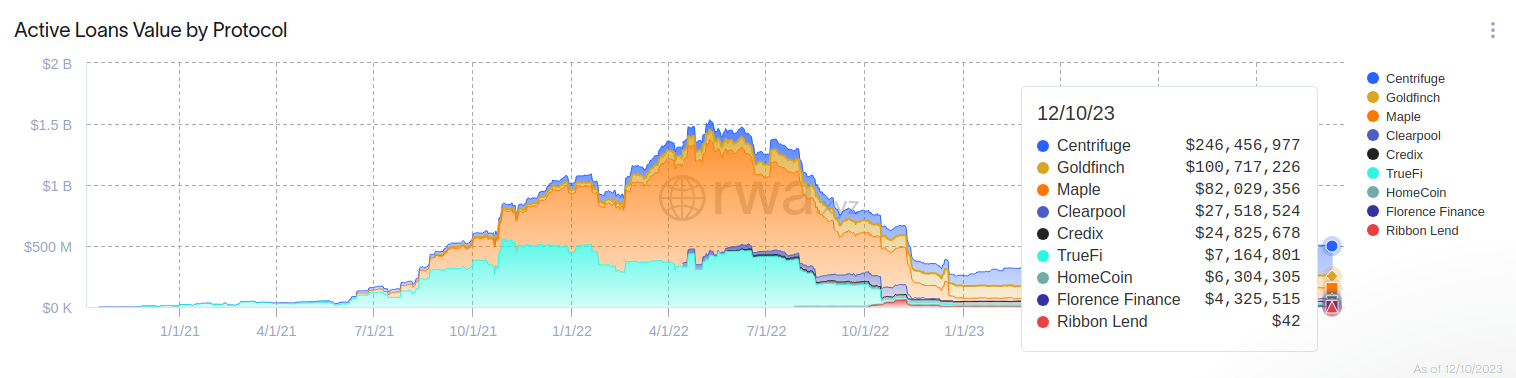

- Current State: The Total Value Locked (TVL), a metric that represents the total funds deposited in RWA platform contracts, stands at $2.5 billion, excluding stablecoins. This figure is indicative of the growing trust and investment in tokenized real-world assets.

- Growth Rate: The TVL has seen an impressive increase of 82% in 2023 alone, signaling rapid market expansion and investor interest.

Total Addressable Market (TAM)

- Future Projection: According to estimates by Outlier Ventures, the TAM for RWA could soar to $20 trillion by 2030. This forecast points to the vast potential for growth and the increasing significance of RWAs in the global asset landscape.

Market Subsegments

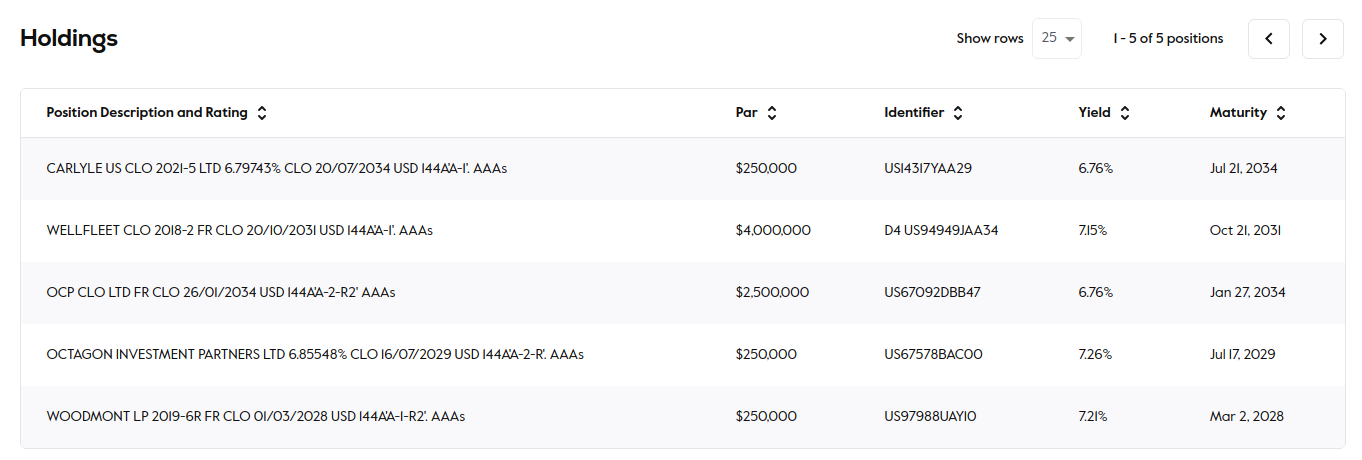

- The RWA market is diverse, with several key subsegments dominating in terms of TVL:

- Gold: With a TVL of $920 million, gold remains a significant and trusted asset within the RWA space.

- US Treasuries: Holding a TVL of $768 million as of December 10, 2023, US Treasuries represent a substantial portion of the RWA market, reflecting their value as secure and stable investments.

- Private Loans: With a TVL of $580 million, the tokenization of private loans underscores the versatility and range of RWAs.

- Tokenization of Real Estate Income: Although smaller in comparison, with a TVL of $178 million, this segment highlights the innovative approaches to generating and managing income through RWAs.

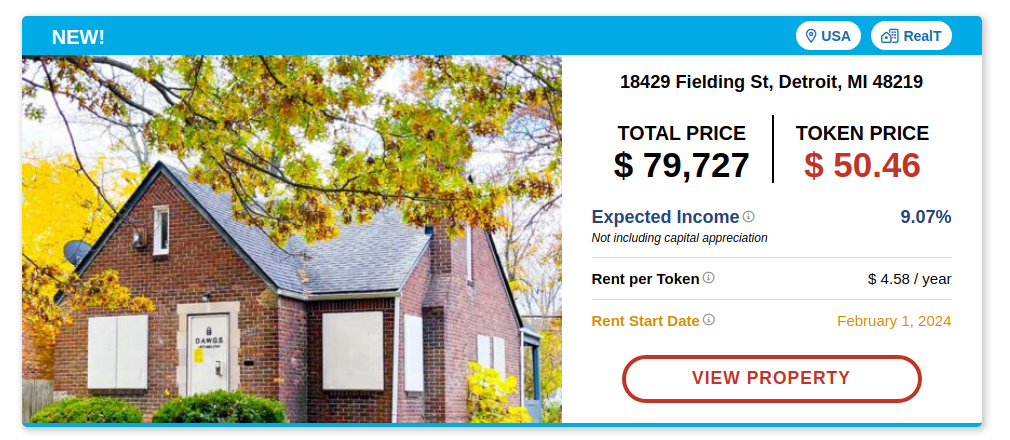

Real Estate and RWA

- Despite frequent media mentions of real estate sales via NFTs, actual cases of entire apartments being sold as NFTs are rare. The primary interest for investors lies in generating regular rental income on-chain. This indicates a preference for the income-generating potential of real estate assets rather than the novelty of owning an asset through NFTs or the act of transaction itself.

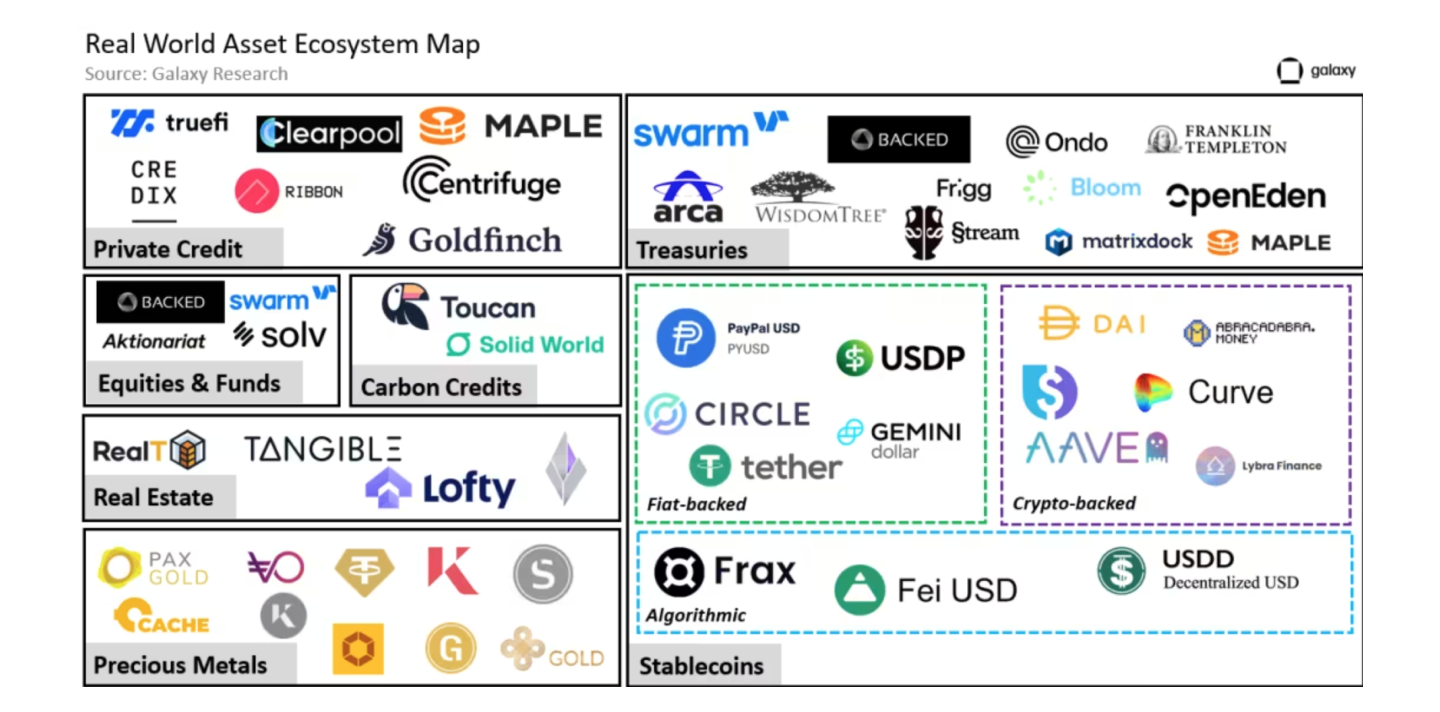

RWAs Ecosystem Map

The cryptocurrency market is vast and varied, with Real-World Assets (RWAs) carving out the largest niche, boasting an impressive market cap of around $120 billion. RWAs bring tangible and intangible assets from the traditional market into the blockchain, offering a myriad of opportunities for investment and ownership. Below are the key types of RWAs:

- Precious Metals: Standing as the second-largest group of RWA assets, precious metals like gold and silver have a market cap of $1.1 billion as of September 2023. They represent a stable and historically reliable investment.

- Real Estate and Land: One of the most significant assets globally, real estate and land can be fractionally tokenized, allowing investors to own parts of physical properties.

- Stocks: Shares in companies can be tokenized, enabling ownership in publicly traded and private corporations through the blockchain.

- Bonds: Both government and corporate bonds can be issued as digital tokens, representing debt investments.

- Commodities: Physical goods such as oil, diamonds, and agricultural products can be tokenized, offering a new form of investment in essential markets.

- Carbon Credits: These represent a permission to emit a certain amount of carbon dioxide or other greenhouse gases, and their tokenization helps in trading and compliance with environmental regulations.

- Income from Assets: Interestingly, the income generated from these assets (like rent from real estate or dividends from stocks) can also be tokenized and traded separately.

- ETFs and Other Tradable Financial Derivatives: These investment funds and financial derivatives that track indexes, commodities, bonds, or a mix of asset types can be tokenized, providing broader market access.

- Private Credit Instruments: Includes tokenized forms of private loans and other credit instruments, offering a new avenue for lending and borrowing.

- Intellectual Property: The rights to inventions, literary and artistic works, symbols, names, and images used in commerce can be tokenized, allowing for the digital management and monetization of intellectual property.

- Works of Art and More: Tokenization extends to the art world, where individual pieces or collections can be digitized for ownership and investment purposes.

Tokenization democratizes access to high-value assets by allowing them to be fractionally owned. Each token represents a stake in the underlying asset, providing rights such as formal ownership or entitlement to income.